Elevated inflation continues to be a top-of-mind preoccupation for households, companies, and policymakers. Why has the post-pandemic inflation proved so persistent? In a Liberty Avenue Economics publish early in 2022, we launched a measure designed to dissect the buildup of the inflationary pressures that emerged in mid-2021 and to know the place the sources of its persistence are. This measure, that we labeled Multivariate Core Pattern (MCT) inflation analyzes whether or not inflation is short-lived or persistent, and whether or not it’s concentrated particularly financial sectors or broad-based.

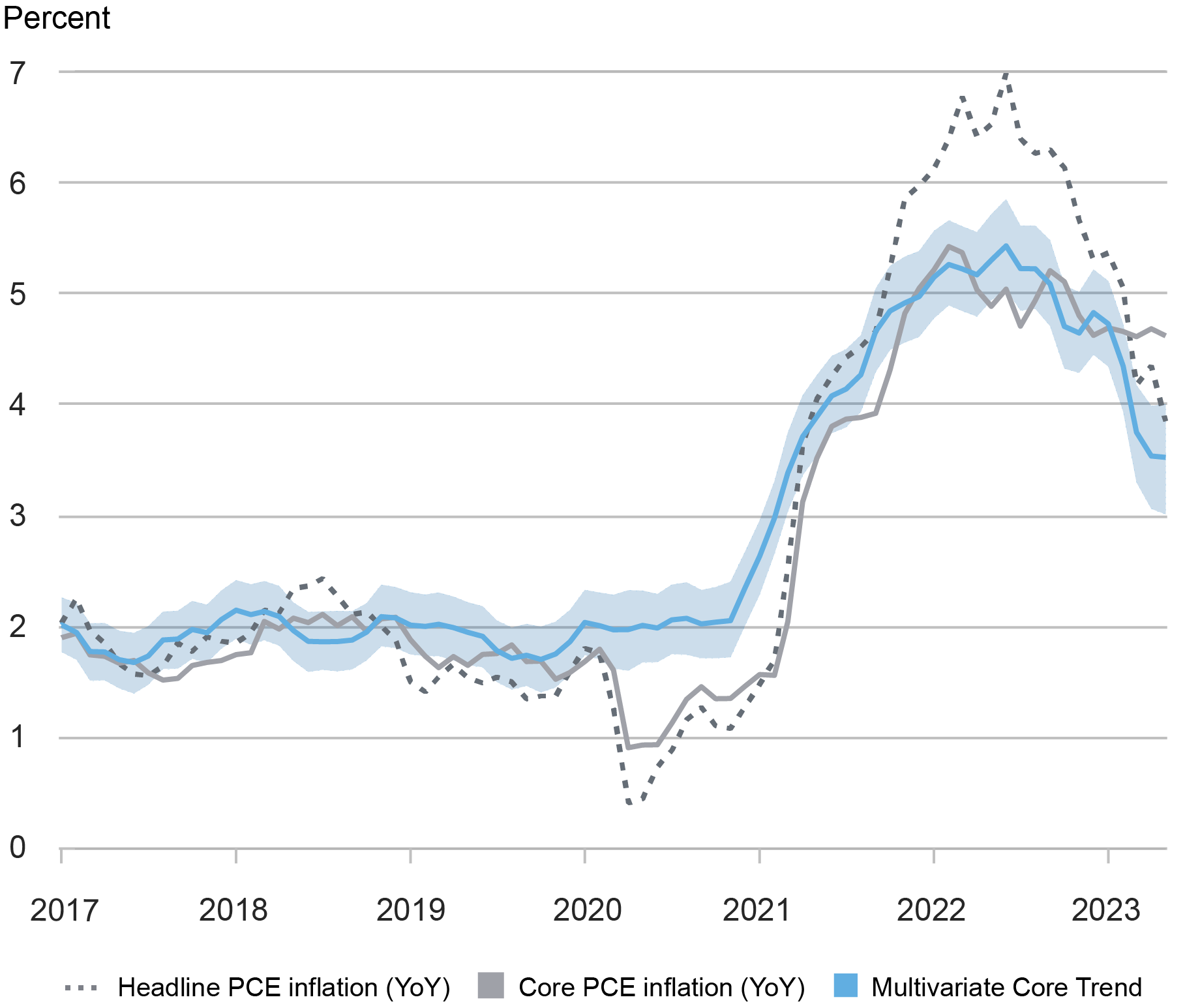

As we documented in a collection of posts (most not too long ago right here), MCT inflation remained roughly steady by way of most of 2020 regardless of a visual drop in headline and core private consumption expenditures (PCE) inflation because of the pandemic (see chart under). Early in 2021 the MCT estimate began to rise, forward of core PCE inflation, and peaked in mid-2022. Its decline since then has been extra notable beginning in March of this yr. Immediately we’re updating the MCT estimates following the discharge of the Might PCE knowledge and we’re launching “Multivariate Core Pattern Inflation” as a standalone product, with new readings to be printed every month on the New York Fed’s public web site, after the Bureau of Financial Evaluation (BEA) official releases.

Multivariate Core Pattern of PCE Inflation

Notes: The twelve-month modifications within the headline and core private consumption expenditures (PCE) value indexes are plotted alongside Multivariate Core Pattern (MCT) inflation for comparability. The shaded space surrounding the MCT estimate is a 68 % chance band.

Methodology

The MCT measure is obtained by a dynamic issue mannequin estimated on month-to-month knowledge for the seventeen main sectors of the PCE value index. The strategy (that builds on this paper) decomposes every sector’s inflation because the sum of a standard development, a sector-specific development, a standard transitory shock, and a sector-specific transitory shock. The development in PCE inflation is constructed from the sectoral stage estimates because the sum of the widespread and the sector-specific tendencies weighted by the expenditure shares. Within the estimation, we use knowledge from all seventeen of the PCE sectors; nonetheless, in establishing the development in PCE inflation, we exclude the risky non-core sectors (that’s, meals and power).

MCT and Core PCE Inflation

The Multivariate Core Pattern mannequin estimate stands at 3.5 % in Might, as in April, after experiencing a considerable moderation within the first a part of the yr. For reference, the twelve-month core PCE inflation fee is at 4.6 %.

Why is the MCT estimate so completely different from twelve-month core inflation charges? The MCT mannequin measures the persistent element of month-on-month core inflation knowledge versus its twelve-month fee. This makes it timelier since transitory shocks have a tendency to stay within the twelve-month measure for too lengthy.

Moreover, the MCT mannequin offers extra weight to sectors which have comparatively few transitory shocks (for instance, housing and meals companies and lodging) and fewer weight to sectors which have giant quantities of noise (for instance, motor autos and transportation). Just lately, low inflation readings occurred in sectors with excessive sign worth, resulting in downward revisions of their tendencies, whereas will increase occurred in sectors with low sign worth, leaving their tendencies principally untouched.

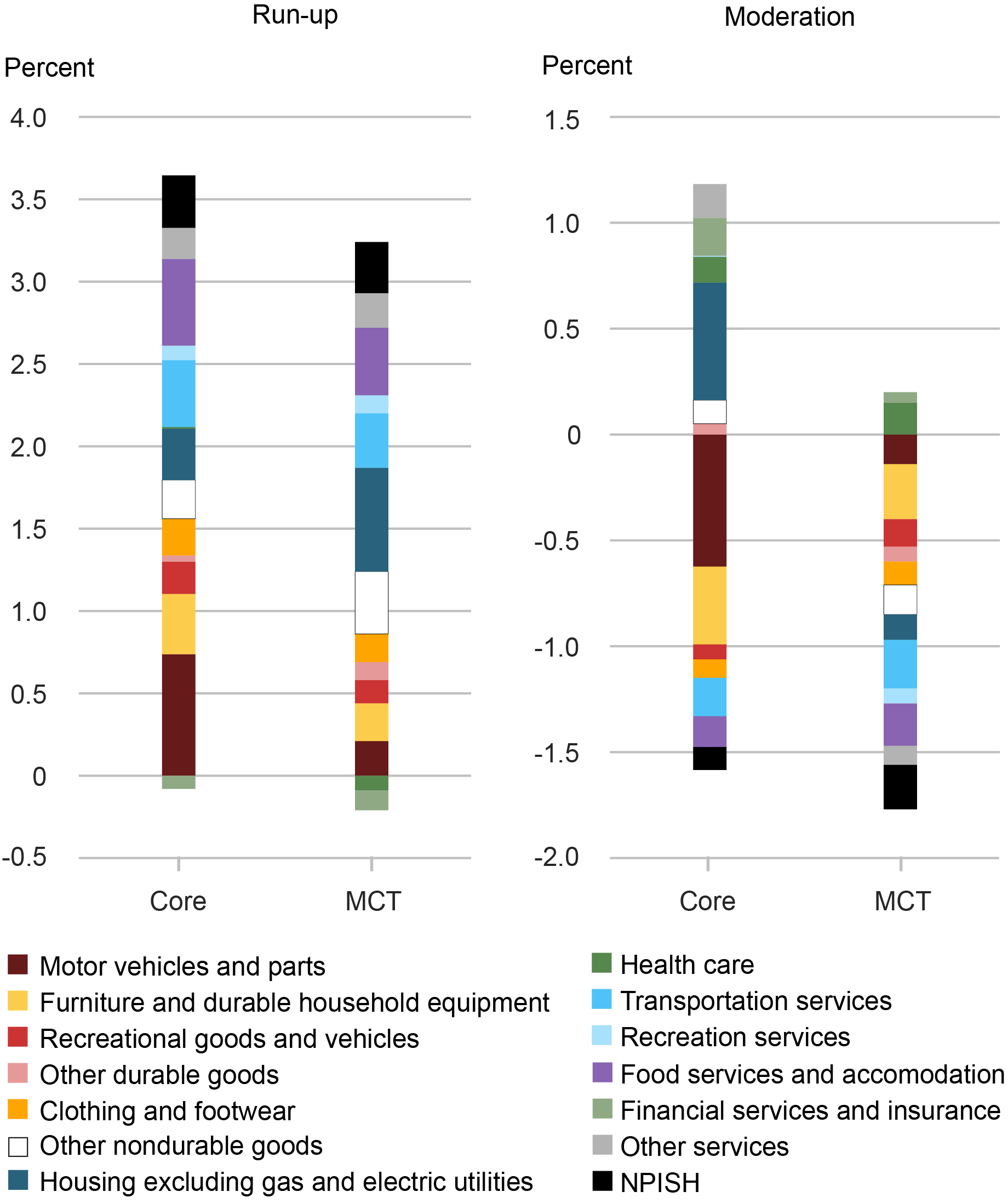

We visualize the variations within the sectors’ contributions to the MCT estimate versus their contributions to the core PCE inflation within the chart under. The 2 panels within the chart evaluate the change in every measure over a interval of run-up in inflation (on the left) and the interval after the MCT peak (labeled “Moderation,” on the precise).

Particularly, the “Run-up” panel experiences every sector’s contribution (color-coded) to the rise in core PCE (left bar) and MCT inflation (proper bar) within the June 2021-Might 2022 interval, the place the contribution is measured relative to their respective pre-pandemic values (January-December 2019). Equally, the “Moderation” panel on the precise offers the sectoral decomposition of the modifications in core PCE and MCT inflation since June 2022 (June 2022 was the current peak of general inflation, whereas it’s close to the current peak for core inflation.)

Because the chart illustrates, the MCT measure takes extra sign from the moderation of inflation in meals companies and lodging (purple bars) than does core inflation, and fewer from the moderation of motorcar inflation (brown bars). The completely different contribution of housing inflation (teal bars) can also be notable. Within the run-up, housing inflation has a bigger constructive contribution to the MCT estimate than to the core PCE measure; throughout the moderation interval, it nonetheless provides constructive stress to the core PCE studying, whereas it contributes to the decline within the MCT measure.

Sectoral Contributions to the Inflation Estimates

Notes: Core is core PCE inflation. MCT is MCT inflation. NPISH is nonprofit establishments serving households.

Certainly, whereas the decline within the inflation development since early 2023 was initially resulting from declines within the mixture core items and non-housing companies inflation, it’s the moderation in month-on-month housing inflation that explains a big a part of the decline in general inflation persistence in the newest months. This moderation, arguably resulting from costs of recent rental contracts, is captured extra clearly by the MCT mannequin by its personal design.

Conclusion

Submit-pandemic imbalances have led to inflation rising effectively above policymakers’ longer-run goal. The MCT framework gives a model-based, sectoral perspective on inflationary pressures: decoding the interrelated dynamics of a number of sectors, the mannequin helps monitoring the extent to which inflation is a broad-based phenomenon and by which sectors it stays most cussed. Equally, it helps decoding the character and the sources of the surge in inflation in addition to its current moderation.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Babur Kocaoglu is a senior analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Argia Sbordone is the top of Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

How you can cite this publish:

Martin Almuzara, Babur Kocaoglu, and Argia Sbordone, “The place Is Inflation Persistence Coming From?,” Federal Reserve Financial institution of New York Liberty Avenue Economics, July 6, 2023, https://libertystreeteconomics.newyorkfed.org/2023/07/where-is-inflation-persistence-coming-from/.

Disclaimer

The views expressed on this publish are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).