A reader asks:

I’m a 34-year-old with a excessive threat tolerance. All of my funding accounts are 100% invested in shares. The one factor I’ve a tough time discovering a tried and true reply on after I do analysis is find out how to greatest allocate my inventory investments amongst large-cap, mid-cap, worldwide, rising markets, and so on. I’m not trying to get the best return doable per se (though that may be good), slightly, I’m trying to have a well-diversified portfolio that offers me publicity to the assorted points of the inventory market in order that my long-term return is 7%-10%. I’ve at all times utilized the next allocation for no different purpose than it appears cheap and is effectively diversified:

-

- 33% U.S. massive cap

- 17% U.S. mid cap

- 16% U.S. small cap

- 20% developed worldwide

- 14% rising markets

Does this appear about proper to you? Would like to know the way you consider your inventory allocation and what you make the most of as an excellent benchmark.

I can’t promise something relating to future returns for the inventory market however a world benchmark for the inventory market is pretty simple.

The world inventory market is an efficient place to begin to match your 100% inventory portfolio to as a result of that’s the investable universe.

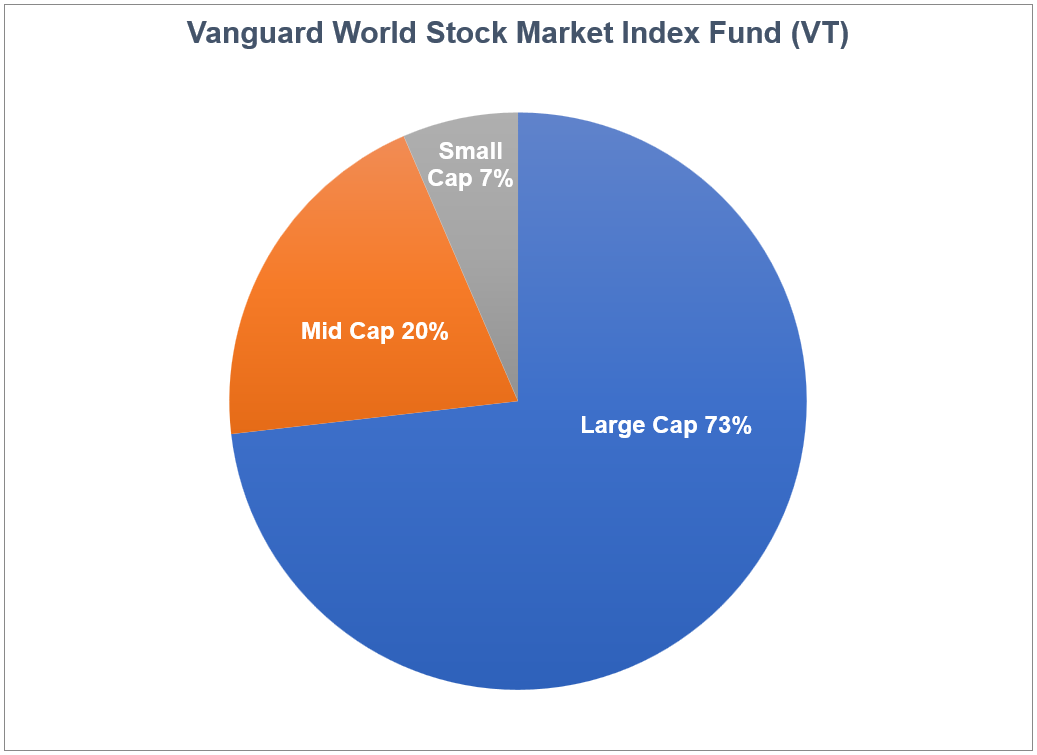

Right here’s the present breakdown primarily based on the Vanguard World Inventory Market ETF (VT):

That’s almost 60% in U.S. shares, one-third in overseas developed shares and slightly below 10% in rising markets.

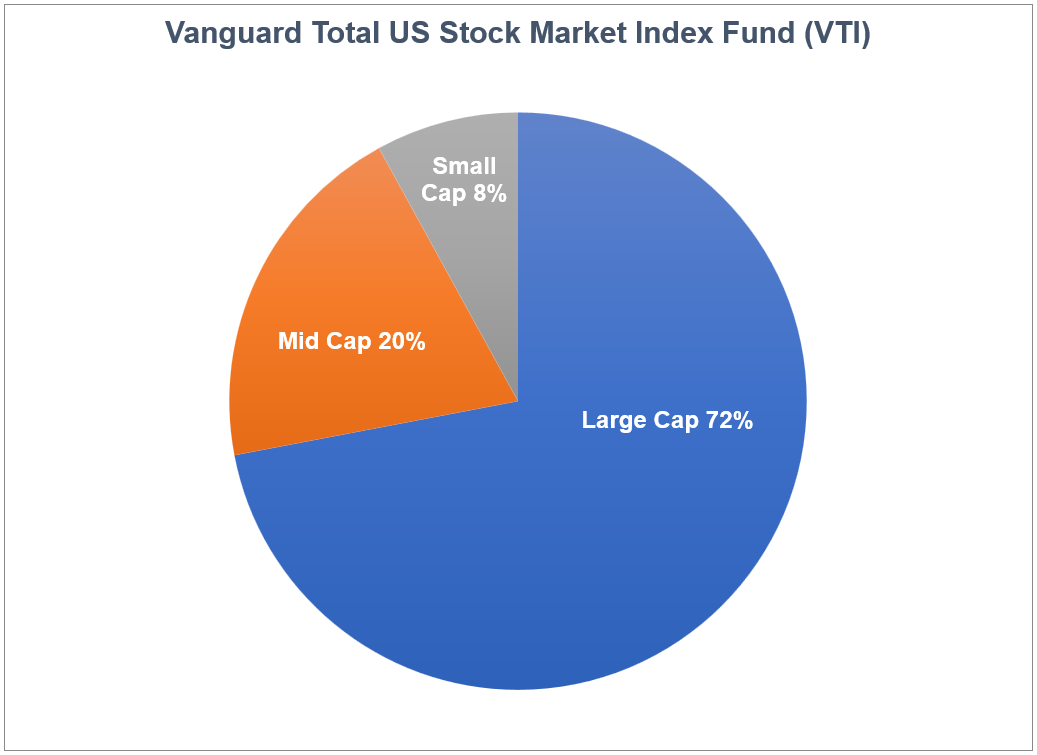

That is market cap breakdown on a world foundation:

The big, mid and small weightings globally are mainly the identical as they’re in the USA:

I’m not saying you need to comply with world weightings (truly the portfolio in query is fairly shut). I simply assume the worldwide market cap is an efficient jumping-off level to see the place you differ from the precise market.

If nothing else, you should utilize the world inventory market as a benchmark for efficiency attribution and perceive the place your bets are being made.

Many buyers in all probability assume the S&P 500 or a complete U.S. inventory market index fund ought to be the benchmark of selection. With the USA making up 60% of the entire pie and getting all the publicity relating to the monetary media, I perceive why this may be the case.

Actually, out of the highest 25 holdings for the Vanguard World Inventory Market Index Fund, simply 4 are overseas firms:

America dominates the inventory market.

I do, nevertheless, nonetheless assume there may be room for diversification in the event you’re going to take a position your total portfolio in shares.

I do know it looks as if the S&P 500 at all times outperforms small caps, mid caps, worldwide developed markets and rising markets however you don’t have to return that far to discover a time when the largest firms in America underperformed.

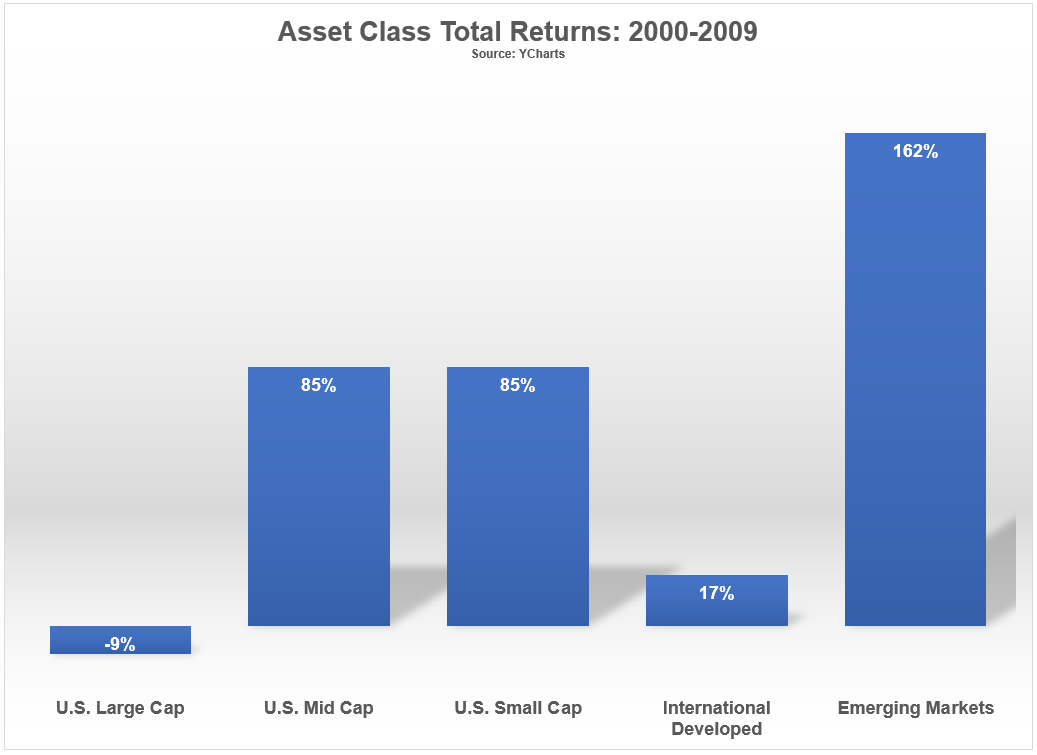

There are the entire returns1 within the first decade of the twenty first century:

It was a misplaced decade for the S&P 500. And diversification saved the day in the event you unfold your bets amongst these different areas of the market.

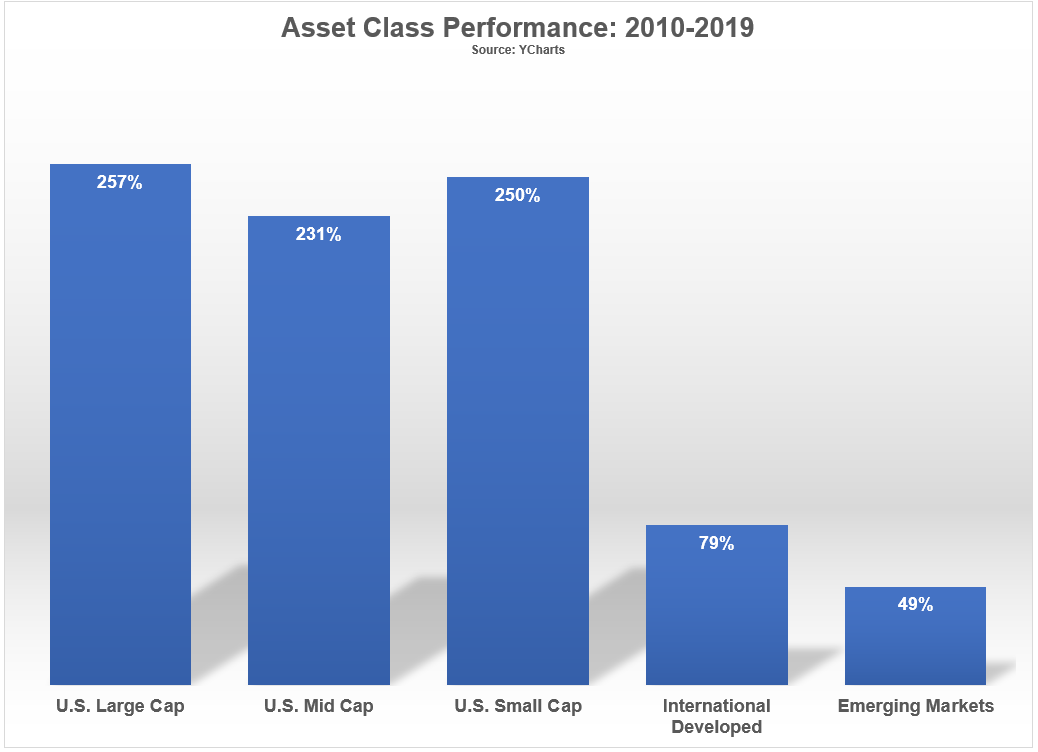

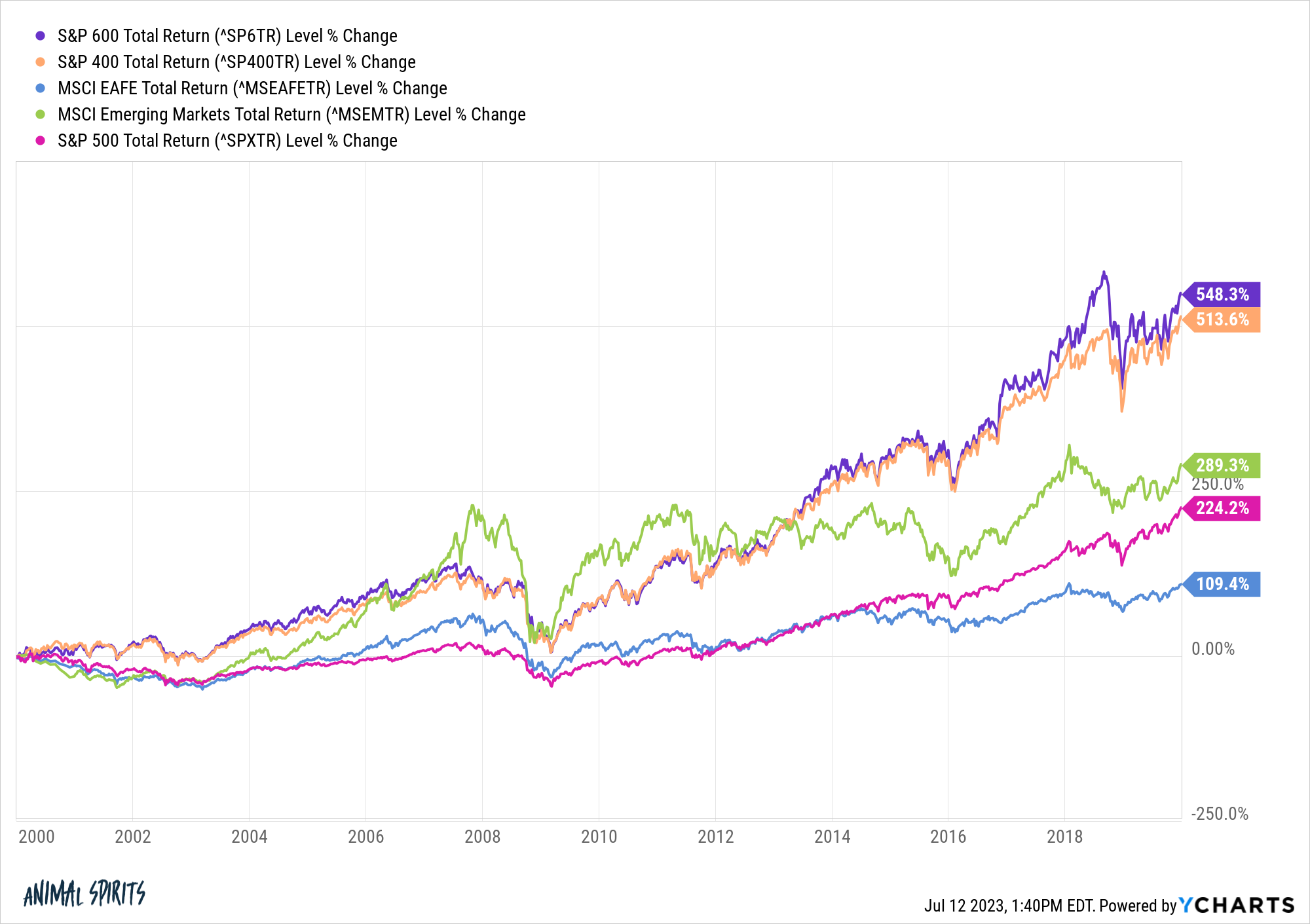

Now right here’s what occurred within the ensuing decade:

The S&P 500 got here again with a vengeance whereas rising markets went from first place to final place.

Now right here’s what it seems to be like if we put all of it collectively for each many years:

Surprisingly, the S&P 500 ranks second to final by way of complete efficiency from 2000-2019.

A few of this has to do with the beginning and finish dates chosen right here. The 12 months 2000 was possible the worst entry level in trendy U.S. inventory market historical past.2 I might change the beginning date and the S&P would have a look at lot higher than this.

However perhaps that’s my level.

You simply by no means know when sure markets, geographies, market caps or threat elements are going to knock the duvet off the ball or strike out.

That’s why I feel diversification is essential, even in the event you plan on investing 100% of your cash within the inventory market.

We talked about this query on this week’s Ask the Compound:

Doug Boneparth joined me on the present this week to debate questions on managing your funds in center age, budgeting for RSUs, monetary planning for households and find out how to allocate between investments and money.

1Right here’s what I used for every asset class right here: S&P 500, S&P 600, S&P 400, MSCI EAFE and MSCI EM.

2September 1929 wasn’t nice both.