My dialogue

about present inflation two weeks in the past centered on the UK. Over a yr

in the past I wrote

a publish known as “Inflation and a possible recession

in 4 main economies”, trying on the US, UK, France and Germany. I

thought it was time to replace that publish for international locations aside from the

UK, with the UK included for comparability and with Italy added for

causes that can turn out to be clear. I additionally wish to talk about generally

phrases how central banks ought to cope with the issue of realizing when

to cease elevating rates of interest, now that the Fed has paused its

will increase, at the least for now.

set

rates of interest to manage inflation

This part shall be

acquainted to many and could be skipped.

If there have been no

lags between elevating rates of interest and their impression on inflation

then inflation management can be similar to driving a automobile, with two

vital exceptions. Altering rates of interest is like altering the

place of your foot on the accelerator (fuel pedal), besides that if

the automobile’s pace is inflation then easing your foot off the pedal is

like elevating charges. To this point really easy.

Exception primary

is that, not like practically all drivers who’ve loads of expertise

driving their automobile, the central banker is extra like a novice who has

solely pushed a automobile a couple of times earlier than. With inflation management, the

classes from the previous are few and much between and are all the time

approximate, and also you can’t be certain the current is similar because the

previous. Exception quantity two is that the speedometer is defective, and

erratically wobbles across the right pace. Inflation is all the time

being hit by non permanent components, so it’s very tough to know what

the underlying pattern is.

If driving was like

this, the novice driver with a dodgy speedometer ought to drive very

cautiously, and that’s what central bankers do. Speedy and enormous

will increase in rates of interest in response to will increase in inflation

may sluggish the financial system uncomfortably rapidly, and will transform

an inappropriate response to an erratic blip in inflation. So

rate of interest setters desire to take issues slowly by elevating

rates of interest progressively. On this world with no lags our cautious

central banker would steadily increase rates of interest till inflation

stopped rising for a couple of quarters. Inflation would nonetheless be too

excessive, so they may increase rates of interest a couple of times once more to get

inflation falling, and because it neared its goal minimize charges to get again

to the rate of interest that stored inflation regular. [1]

Lags make the entire

train far tougher. Think about driving a automobile, the place it took

a number of minutes earlier than shifting your foot on the accelerator had a

noticeable impression on the automobile’s pace. Moreover if you did

discover an impression, you had little concept whether or not that was the complete

impression or there was extra to come back from what you probably did a number of minutes

in the past. That is the issue confronted by those that set rates of interest. Not

really easy.

With lags, collectively

with little expertise and erratic actions in inflation, simply

inflation can be silly. As rates of interest largely

affect inflation by influencing demand, an rate of interest setter

would wish to take a look at what was taking place to demand (for items and

labour). As well as, they’d seek for proof that allowed

them to tell apart between underlying and erratic actions in

inflation, by issues like wage progress, commodity costs,

mark-ups and many others.

Understanding

present inflation

There are

basically two tales you possibly can inform about latest and present

inflation in these international locations, as Martin

Sandbu notes. Each tales begin with the commodity

worth inflation induced by each the pandemic restoration and, for Europe

specifically, the battle in Ukraine. As well as the restoration from the

pandemic led to varied provide shortages.

The primary story

notes that it was all the time wishful considering that this preliminary burst of

inflation would haven’t any second spherical penalties. Most clearly,

excessive vitality costs would increase prices for many corporations, and it will

take time for this to feed via to costs. As well as nominal

wages had been certain to rise to some extent in an try to cut back the

implied fall in actual wages, and lots of corporations had been certain to take the

alternative introduced by excessive inflation to boost their revenue margins

(copy cat inflation). However simply because the commodity worth inflation was

non permanent, so shall be these second spherical results. When headline

inflation falls as commodity costs stabilise or fall, so will wage

inflation and replica cat inflation. On this story, rate of interest

setters should be affected person.

The second story is

moderately completely different. For numerous (nonetheless unsure) causes, the

pandemic restoration has created extra demand within the labour market, and

maybe additionally within the items market. It’s this, moderately than or as effectively

as larger vitality and meals costs, that’s inflicting wage inflation and

maybe additionally larger revenue margins. On this story underlying

inflation is not going to come down as commodity costs stabilise or fall,

however could go on rising. Right here rate of interest setters must maintain

elevating charges till they’re certain they’ve executed sufficient to remove

extra demand, and maybe additionally to create a level of extra provide

to get inflation again down to focus on.

After all actuality

might contain a mixture of each tales. In final yr’s publish I

put this assortment of nations into two teams. The US and UK

appeared to suit each the primary and second story. The labour market was tight within the US due to a powerful

pandemic restoration helped by fiscal enlargement, and within the UK as a result of

of a contraction in labour provide partly as a consequence of Brexit. In France and

Germany the primary story alone appeared extra possible, as a result of the pandemic

restoration appeared pretty weak when it comes to output (see beneath).

Proof

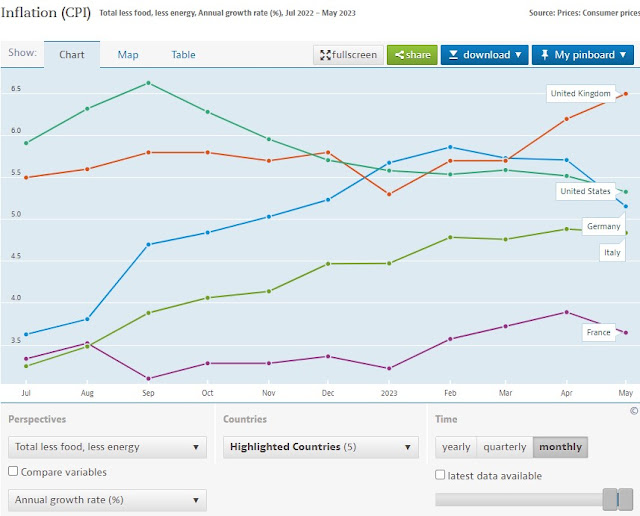

In my publish two weeks

in the past I included a chart of precise inflation in these 5 international locations.

Here’s a measure of core inflation from the OECD that excludes all

vitality and meals, however doesn’t exclude the impression of (say) larger

vitality costs on different components of the index as a result of vitality is an

vital value.

Core inflation is

clearly falling within the US (inexperienced), and rising within the UK (purple). In

Germany (mild blue) core inflation having risen appears to have

stabilised, and the identical could be true in France and Italy very

lately. The identical measure for the EU as a complete (not proven) additionally

appears to have stabilised.

If there have been no

lags (see above) this may counsel that within the US there isn’t a want

to boost rates of interest additional (as inflation is falling), within the UK

rates of interest do must rise (as they did final month), whereas within the

Eurozone there is likely to be a case for modest additional tightening.

Nevertheless, when you enable for lags, then the impression of the will increase in

charges already seen has but to come back via, so the case for preserving

US charges secure is stronger, the case for elevating UK charges much less clear

(the most recent MPC vote was cut up, with 2 out of seven wanting to maintain charges

unchanged) , and the case for elevating charges within the EZ considerably

weaker. (The case towards elevating US charges will increase additional as a result of

of the

contribution of housing, and falling wage inflation.)

As we famous on the

begin, due to lags and non permanent shocks to inflation it’s

vital to take a look at different proof. An ordinary measure of extra

demand for the products market is the output hole. Based on the IMF,

their estimate for the output hole in 2023 is about 1% for the US

(constructive implies extra demand, damaging inadequate demand), zero

for Italy, -0.5% for the UK (and the EU space as a complete), and -1% for

Germany and France. In observe this output hole measure simply tells

you what has been taking place to output relative to some measure of

pattern. Output in comparison with pre-pandemic ranges is powerful within the US,

has been fairly sturdy in Italy, has been fairly weak in France, even

weaker in Germany and horrible within the UK (see beneath for extra on

this).

I need to admit {that a}

yr in the past this satisfied me that rate of interest will increase weren’t

required within the Eurozone. Nevertheless if we take a look at the labour market

right this moment issues are moderately completely different. Ignoring the pandemic interval,

unemployment has been falling steadily since 2015 in each Italy and

France, and for the Euro space as a complete it’s decrease than at any time

since 2000. In Germany, the US and UK unemployment appears to have

stabilised at traditionally low ranges. This doesn’t counsel

inadequate demand within the labour market within the EZ. Unemployment knowledge

is way from a perfect measure of extra demand within the labour market,

so the chart beneath plots one other: employment divided by inhabitants,

taken from the most recent IMF WEO (with 23/24 as forecasts).

As soon as once more there’s

no suggestion of inadequate demand in any of those 5 international locations.

(The UK is the one exception, till you be aware how a lot the NHS disaster

and Brexit have diminished the numbers accessible for work because the

pandemic.)

This and different

labour market knowledge suggests our second inflation story outlined in

the earlier part could not simply be true for the US and UK, however could

apply extra typically. It’s why there’s a lot concentrate on wage

inflation in making an attempt to know the place inflation could also be heading. Of

course a decent labour market doesn’t essentially indicate curiosity

charges must rise additional. For instance within the US each wage and worth

inflation appear to be falling regardless of a fairly sturdy labour

market, as our first inflation story steered they may. The

Eurozone is six months to a yr behind the US within the behaviour of

each worth and wage inflation, however in fact rates of interest within the EZ

haven’t risen by as a lot as they’ve within the US.

Good, dangerous and

ugly pandemic recoveries

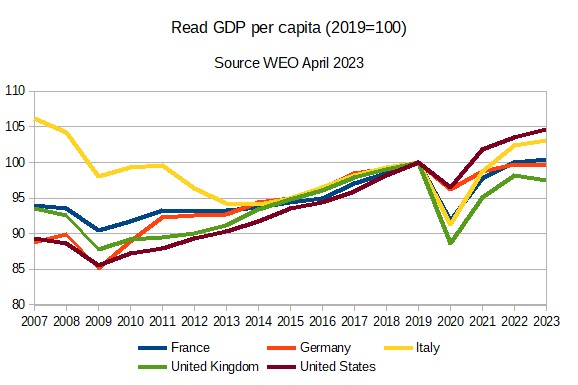

The chart beneath

appears at GDP per capita in these 5 international locations, utilizing the most recent IMF

WEO for estimates for 2023.

Initially I’ll

concentrate on the restoration because the pandemic, so I’ve normalised all

sequence to 100 in that yr. The US has had a very good restoration, with GDP

per capita in 2023 anticipated to be 5 p.c above pre-pandemic

ranges. So too has Italy, which is forecast to do nearly as effectively.

That is notably excellent news provided that pre-pandemic ranges of GDP

per capita had been beneath ranges achieved 12 years earlier in Italy.

Germany and France

have had poor recoveries, with GDP per capita in 2023 anticipated to be

much like 2019 ranges. The UK is the ugly certainly one of this group, with

GDP per capita nonetheless effectively beneath pre-pandemic ranges, one thing I

famous in my publish two weeks in the past. In contrast to a yr in the past, there isn’t a motive

to suppose these variations are largely brought on by extra demand or

provide, so it’s the proper time to boost the query of why there

has been such a pointy distinction within the extent of bounce again from

Covid. To place the identical level one other manner, why has technical progress

apparently stopped in Germany, France and the UK since 2019.

A part of the reply

could also be that this displays lengthy standing variations between the US

and Europe. Here’s a desk illustrating this.

|

Actual GDP per capita progress, |

2000/1980 |

2007/2000 |

2019/2007 |

2023/2019 |

|

France |

1.8 |

1.2 |

0.5 |

0.1 |

|

Germany |

1.8 |

1.4 |

1.0 |

-0.1 |

|

Italy |

1.9 |

0.7 |

-0.5 |

0.8 |

|

United Kingdom |

2.2 |

1.8 |

0.6 |

-0.7 |

|

United States |

2.3 |

1.5 |

0.9 |

1.1 |

Progress in GDP per

capita within the US has been considerably above that in Germany, France

or Italy since 1980. No less than a part of that’s as a result of Europeans have

chosen to take extra of the proceeds of progress in

leisure. Nevertheless this distinction is nothing just like the hole in progress

that has opened up since 2019. (I make no apology in repeating that

progress within the UK, not like France or Germany, stored tempo with the US

till 2007, however one thing should have occurred after that date to

reverse that.)

I do not know why

progress within the US since 2019 has been a lot stronger than France or

Germany, however solely a listing of questions. Is the absence of a European

sort furlough scheme within the US vital? Italy suggests in any other case,

however Italy could merely have been recovering from a horrible earlier

decade. Does the giant

enhance in self-employment that occurred in the course of the

pandemic within the US have any relevance? [1] Or are these variations

nothing to do with Covid, and as an alternative do they only replicate the bigger

impression in Europe of upper vitality costs and potential shortages due

to the Ukraine battle. If that’s the case, will falling vitality costs reverse these

variations?

[1] If wage and

worth setting was based mostly on rational expectations the dynamics would

be moderately completely different.

[2] Earlier than

anti-lockdown nutters get too excited, the IMF count on GDP per capita

in Sweden to be related in 2023 to 2019.